Perpetual bond formula

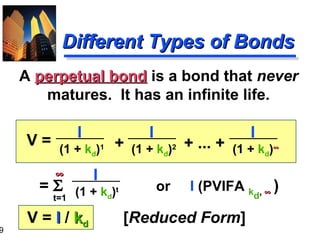

First of all we know that the coupon payment every year is 100 for an infinite amount of time. Bonds which never mature are very rare.

Preferred Stocks Live Longer Than Bonds But Not Always Seeking Alpha

Current Yield Annual Dollar Interest Paid Market Price X.

. Yield of a perpetual bond Tags. And the discount rate is 8. In India such bonds or debentures are not found.

Hence the perpetual bond price is presented as the. PVA A 1K-1 A 1K. Perpetual Bond is an infinite series coupon paying bond.

You can calculate this value using this growing perpetuity formula. We can calculate the yield on a perpetual bond with the following formula. Where refers to the price of the bond.

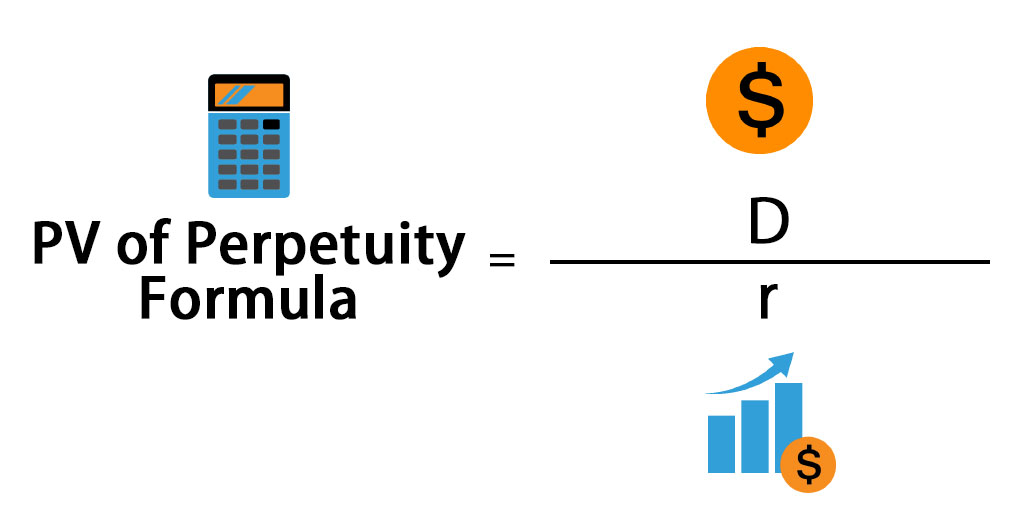

If a perpetual bond pays 10000 per year and the discount rate is 4 the. Using the formula we get PV of Perpetuity D r 100 008. Valuing perpetual bonds is simple.

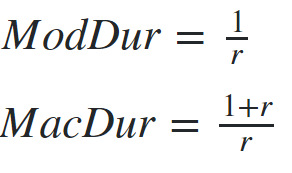

Formula r fracIP Legend I. R refers to the Interest. Formula for the Present Value of Perpetual Bond presently Dr And r is the bonds discount rate.

The formula that is used to calculate the yield on a perpetuity is the payment divided by the present value of the perpetuity. A perpetuity is a form of annuity that has an infinite amount of. Perpetual bonds are valued using the formula.

The perpetual bond formula is as follows. Price of a perpetual bond Tags. Where I is the annual interest payment received by the.

Hence mathematically its Present Value can be written as follows. Bonds pricing and analysis Description Formula for the calculation of the yield of a perpetual bond. C refers to the Amount of continuous cash payment.

Below you will find descriptions and details for the 1 formula that is used to compute yields for perpetual bonds. Its actually the easiest bond to value. Current Yield Annual Coupon Amount in Dollarsmarket value of the bond 100 Current Yield 005 100 95.

Bonds pricing and analysis Description Formula for the calculation of the price of a perpetual bond. In a perpetual bond there is no maturity or terminal value. PV C R.

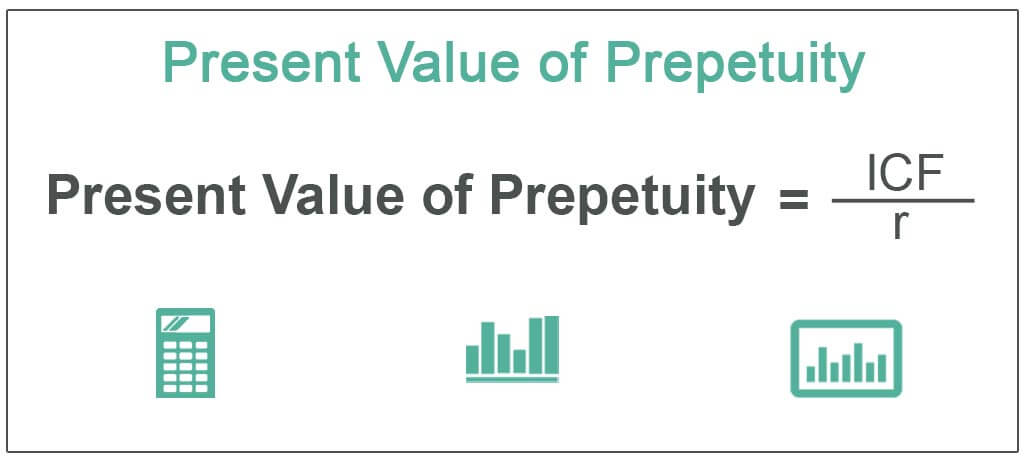

Formula Derivation. Formula of Perpetual Bond The formula for calculating present value is D divided by r. D is the coupon payment or regular payment on the bond and r is the discount rate.

As such perpetual bonds even though they pay interest forever can be assigned a finite value which in turn represents their price. The formula for calculation of value of. Investors can calculate how much return they will earn from a perpetual bond by using the following formula.

PV refers to the Present value. Extracting the investors real value of interest income obtained from consol bonds depends on applying the present value concept. Most of these bonds are callable but the first call date is never less than five years from the date of issuea call protection period.

Denotes the Coupon Payment and. Formula for the Present Value of a. Formula P fracIr Legend I.

Present Value Of Perpetuity How To Calculate It Examples

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How To Calculate Pv Of A Different Bond Type With Excel

How Can I Calculate The Present Value Of A Bond Using Ytm Economics Stack Exchange

Explaining Consol Bonds Perpetual Bonds Corporate Finance Youtube

Pv Of Perpetuity Formula With Calculator

Yield To Call Ytc Bond Formula And Calculator

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

The Valuation Of Long Term Securities

Perpetuity Formula Calculator With Excel Template

Perpetual Bond Formula Duration Valuation What Is It

Bond Yield Formula Calculator Example With Excel Template

What Is A Perpetuity Definition Formula Video Lesson Transcript Study Com

Present Value Of Growing Perpetuity Formula With Calculator

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

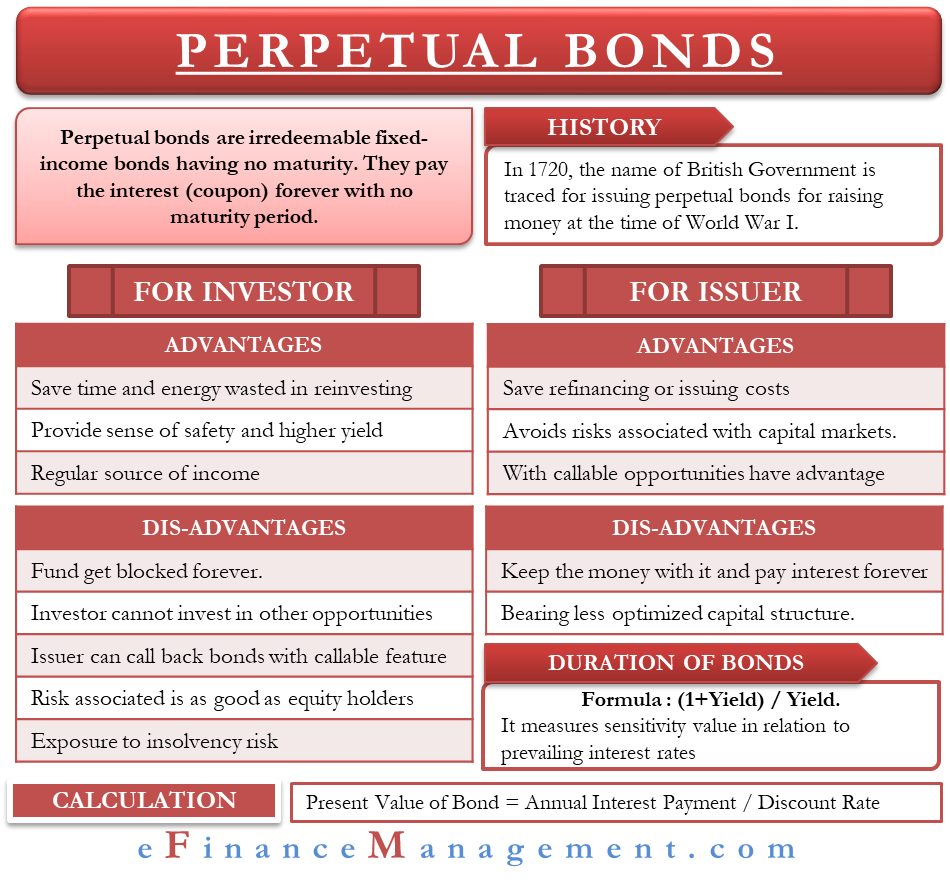

Perpetual Bonds Define Advantages Disadvantages Calculate Duration